child tax credit payment schedule 2022

The advanced payments of the credit will continue in 2022 as Build Back Better Act. 3 January - England and Northern Ireland only.

Advanced Child Tax Credit Charlotte Center For Legal Advocacy

THOUSANDS of residents across multiple states are receiving up to 750 in direct payments due to new programs starting.

. Romney Family Security Act CTC No Payfors Romney Family Security Act CTC With Payfors 3000 CTC with 500 fully available regardless of earned income. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to. The 2022 Child Tax Credit is available to parents with dependents under the age of 17 at the end of the year 31 December 2022 and who meet certain eligibility requirements.

Since Congress did not extend the higher child tax credit amounts CTCs revert back to 2000 per child. As part of the American Rescue Act signed into law by President Joe Biden in. Up to 3600 per child or up to 1800 per child if you received.

Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit. The child tax credit has been the biggest helper to taxpayers with qualifying children under 18. Back in 2021 for couples making less than 150000 dollars or singles making less than 75000 dollars the full 3600 dollar Child Tax Credit was available.

For those filing an extension by the October 17 extended. Child income tax credit 20. Income-based JSA income-related ESA Income Support or Pension Credit for any day in the period 26 August 2022 to 25 September 2022.

Eligible Connecticut residents can now claim a tax. Child Tax Credit 2022. You can fill this form out before the upcoming tax deadline which is April 18 for filing tax returns for the 2021 financial.

To receive 2022 child tax credit payments families. Stimulus check for advance child tax credit 2022 payments. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States.

Those who are filing an extension by the October 17 extended. Wait 10 working days from the payment date to contact us. In Rhode Island families will get 250 per child and a maximum of 750 total for up to three children with direct payments going out beginning in October.

Direct Payments Of 1050 For Millions Of Americans Is Scheduled. Parents of eligible children must have an adjusted gross income agi of less than 200000 for single. For taxpayers who filed an original or amended return by August 31 your rebate will be issued starting in October 2022.

Those who make 6000 or less could get a 500 refundable tax credit for each qualifying child under a bill pending approval by Gov. Refunds totaling 95 billion are being given to Californians. Enhanced child tax credit.

How much is child tax credit for 2022. How much money you could be getting from child tax credit and stimulus payments. For those who filed an original or amended return by August 31 their rebate will be issued starting in October 2022.

You simply have to fill out Schedule 8812 Form 1040. 22 rows 28 December - England and Scotland only. Tax credit-only customers who will.

What is the child tax credit. Alberta child and family benefit ACFB All payment dates. To be a qualifying.

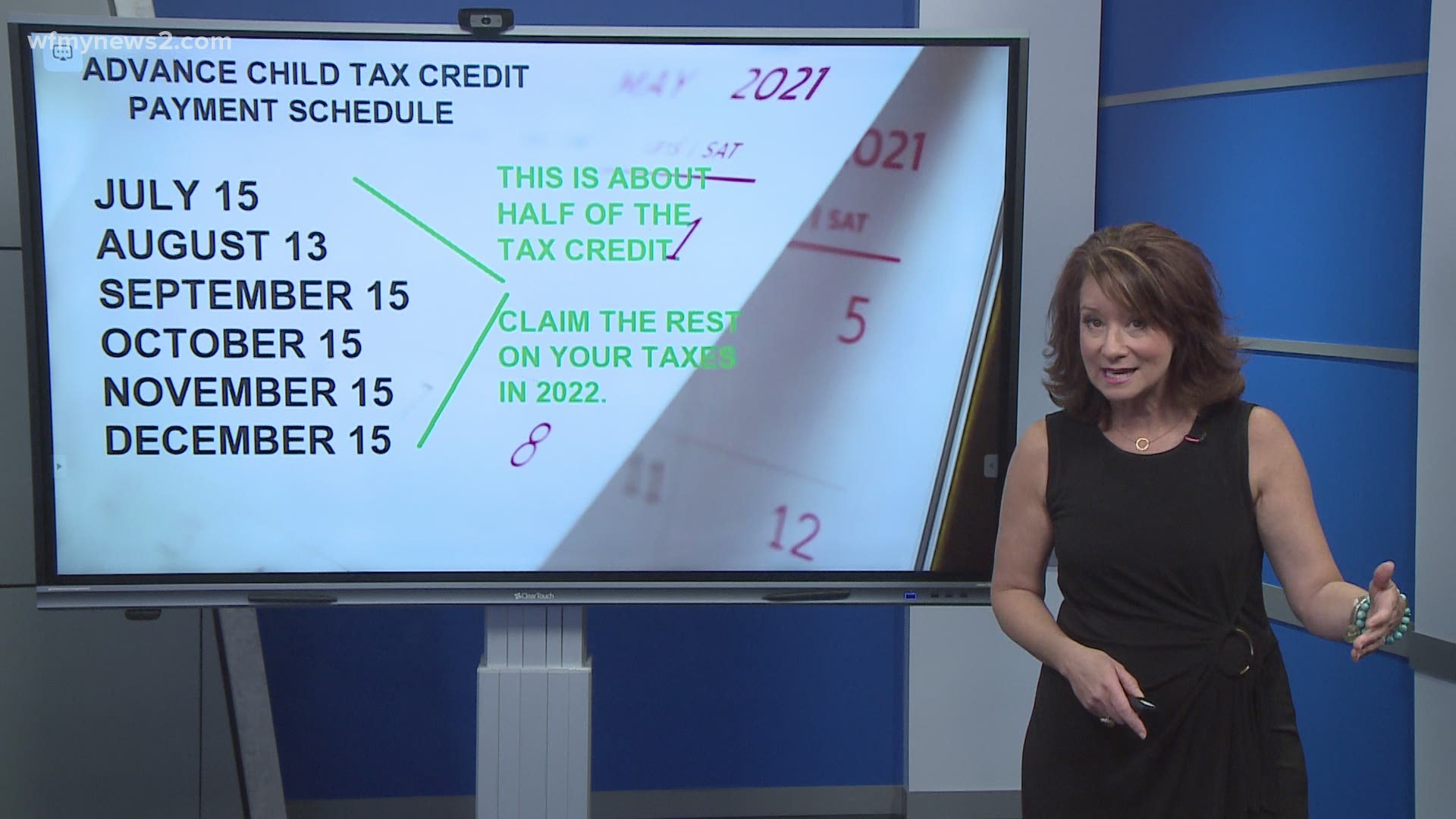

IR-2022-181 Grandparents and other relatives with eligible dependents can qualify for 2021 Child Tax Credit IR-2022-106 Face-to-face IRS help without an appointment. Child Tax Credit Stimulus Monthly Payment Schedule 2022. How do you apply.

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Irs Letters 6419 And 6475 For The Advance Child Tax Credit And Third Stimulus What You Need To Know The Turbotax Blog

Remember That The Child Tax Credit Padden Cooper Cpa S Facebook

Child Tax Credit 2022 How Much Is It And When Will I Get It The Sun

/do0bihdskp9dy.cloudfront.net/02-01-2022/t_b29bf212b10f46eb833712837080bb76_name_file_1280x720_2000_v3_1_.jpg)

Child Tax Credit Payments What S Next

Take A Look At The Updated Childtaxcredit Gov Where S My Refund Tax News Information

Enhanced Child Tax Credit Will Revert To Original 2 000 For 2022 Gobankingrates

Child Tax Credit How Families Can Get The Rest Of Their Money In 2022

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Goodbye Godsend Expiration Of Child Tax Credits Hits Home Chicago News Wttw

Irs Letter 6419 For Child Tax Credit May Have Inaccurate Information

Expanded Child Tax Credit Available Only Through The End Of 2022 Cbs Los Angeles

Irs Makes First Payments Of Advanced Child Tax Credit On July 15 Wfmynews2 Com

Parents Guide To The Child Tax Credit Nextadvisor With Time

Child Tax Credit 2022 What Changes Will There Be In The New Tax Season As Usa

Child Tax Credit 2022 Families Can Claim Direct Payments Worth Up To 3 600 Due To Irs Mistake See If You Qualify The Us Sun

Child Tax Credit 2022 Monthly Stimulus Payment Schedule Who Qualifies Youtube

Child Tax Credit Update Families Will Get Paid 7 200 Per Child In 2022 By Irs Fingerlakes1 Com